Right the first time and onward.

Enable Device lifecycle management

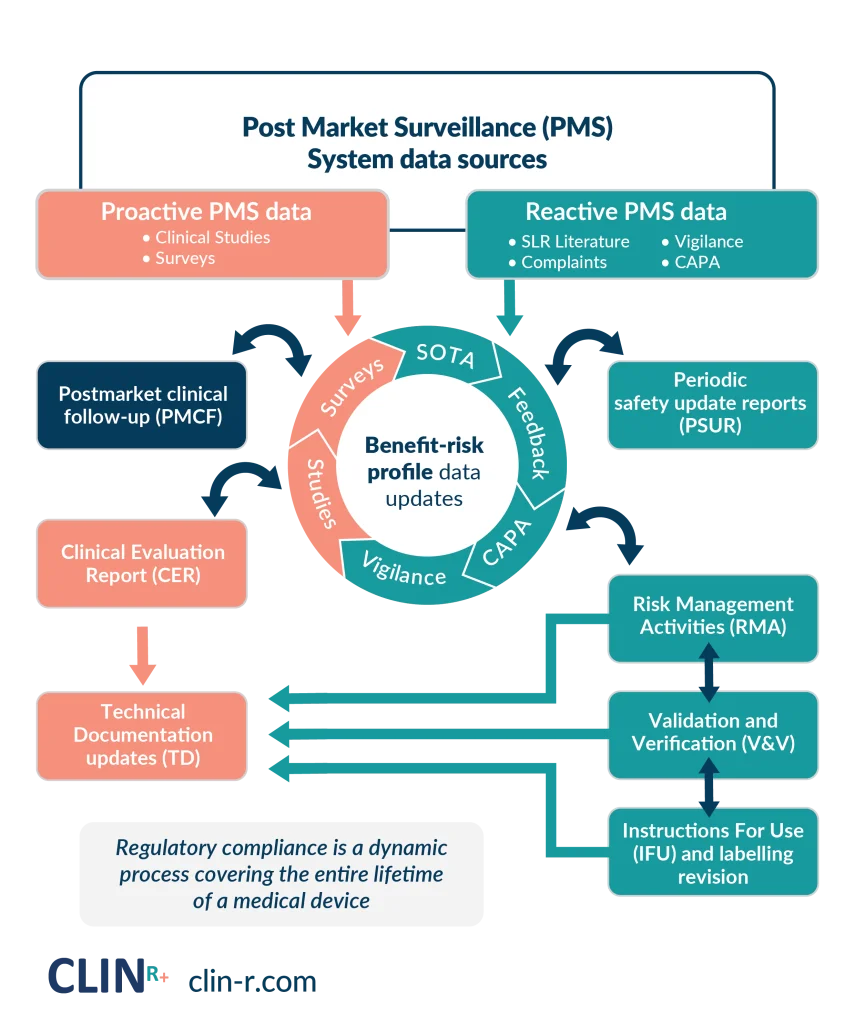

POST MARKET SURVEILLANCE

Automation of PMS systems to meet annual audits and support product innovation.

What is the benefit?

Work with a consulting firm that effectively expands your businesss. We help simplify your post-market product feedback to regulators. Provide the PMS clinical data to support your CE audits and turn data into insights to support your product to be best in market.

Reduce the number of deficiency findings during your CE audits. Use inhouse data to build clinical claims.

Create an extension to your business to have PMS and regulatory expertise on demand. Optimise your current PMS workflow to real-time insights and quickly generate your PMSR/PSUR to ensure audit readiness every time.

Need support on PMS (Post Market Surveillance?)

If these problems are affecting you, we can help:

Don’t have the in-house resources or expertise to have realtime PMS data or automate your PMSR/PSUR!

Your current PMS plan and PSUR had deficiency findings in your current audit.

Are you unsure if your current PMSR/PSUR will meet the EU MDR requirements?

Your legacy PSUR has had deficiency findings in one or more of your total 3 reviews with your notified body.

Is your PMS workflow EU MDR ready?

Unsure?

Why not book a free 15 min assessment with an experienced consultant to pre-assess your auditors (NB) response. You will receive a personalised score card to guide your corrective action plan.

PMS automation or PSUR

production timelines

The timeline of each PMS project differs While specific project durations may vary, we have average estimates to help you plan.

- MDR PMS plan remediation

- PMS & Risk SOP remediation

- PSUR

- PMS benefit-risk threshold

- PMS automation

- 2 weeks

- 1 - 4 weeks

- 1 - 4* weeks

- 2 - 4* weeks

- 3 - 8* weeks

PMS automation or PSUR

production costs

It is hard to provide an accurate answer for this as there are many factors that play into aligning your PMS process or resolving non-conformities, so it depends on the gap assessment. We have provided average costs as a guide, but you can book a call with our team to confirm the exact costs for your project.

- Update PSUR/PMSR

- PMS & Risk SOP remediaion

- Risk and PMS remediation

- PMS benefit-risk threshold

- PMS automation

- £500 - £5,500

- £2,500 - £7,000

- £2,500 - £12,500

- £500 – £16,600

- £3,000 - £16,000

Next steps to get CLIN-r+ insight:

01.

Book a 30 minute introduction call

for a rapid gap analysis.

02.

Receive a personalised

gap assessment and detailed project proposal.

03.

Onboard the CLIN-r+ team and spend time on daily business,

where it matters.

How can Clin-r+ help?

See our PMS FAQs or whitepapers below for common questions asked by manufacturers or contact us to discuss your specific needs. In addition to other services, we can conduct a gap assessment to help ensure your next audit runs smoothly.

Not ready to book a call?

No problem, have a look at a few of our articles on Clinical Evaluation Workflow:

Right the first time and onward. Enable Device lifecycle management POST MARKET SURVEILLANCE Automation of PMS systems to meet annual audits and support product innovation....